how to calculate nj taxable wages

More help with capital gains calculations and tax rates. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate.

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

On January 3 2014 the Internal Revenue Service issued Notice 2014-7 2014-4 IRB.

. Income Taxable in Another Jurisdiction Exempt From Tax in NJ Income must be taxed by bothNew Jersey and the other jurisdiction to be included on Schedule NJ-COJ. In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Enter the FUTA taxable wages and the reduction rate see page 2.

Multiply the FUTA taxable wages by the reduction rate and enter the credit reduction amount. 5 on more than 6000 of taxable income for married joint filers and more than 3000 for all others. Box wages that were excluded from state unemployment tax see the instructions for Step 2.

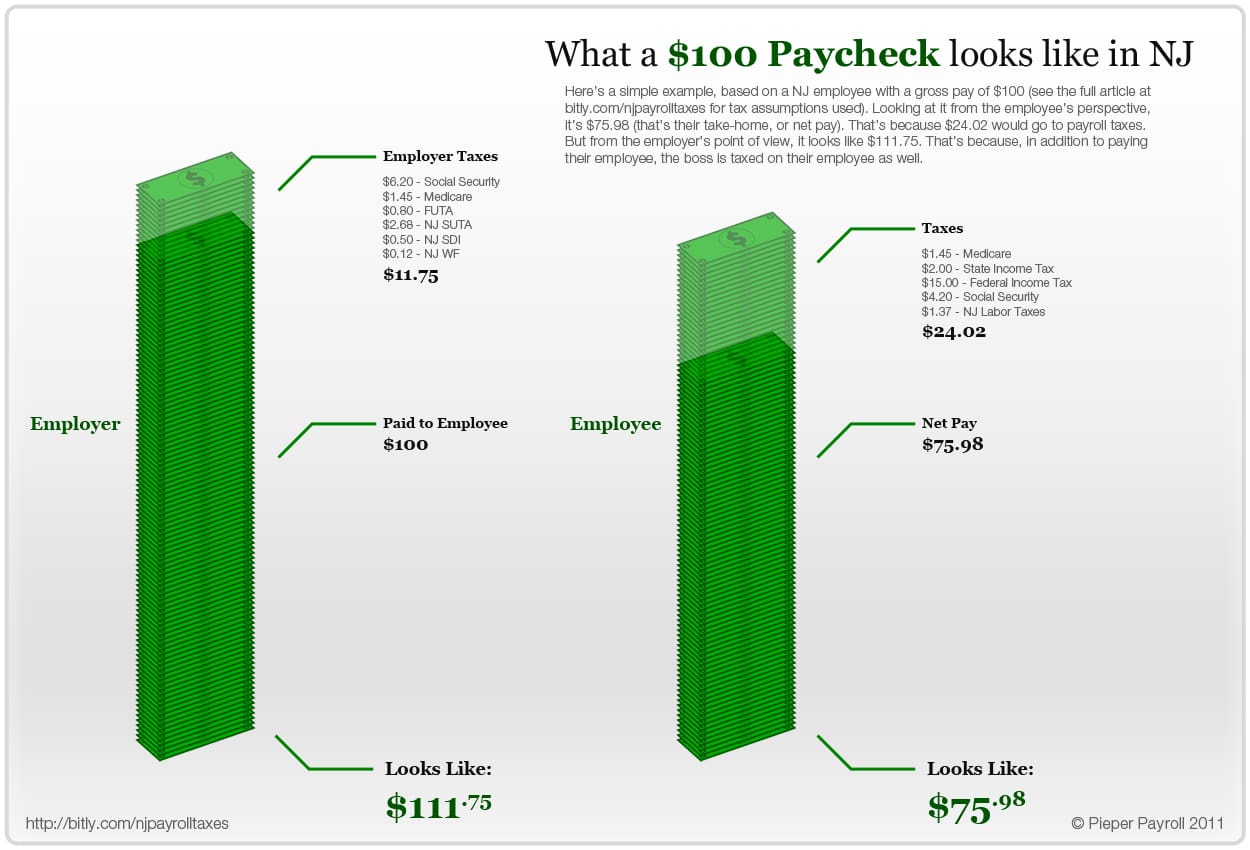

That is because you may have to use a different method to calculate the taxable amount for your New Jersey return than the method used for federal income tax purposes. So for a 10000 bonus youd have 2200 withheld in federal income taxes and receive 7800. How we calculate rates.

Plans from their wages are not taxable a s of January 1 1984. Once you report all of your income on your Form 1040 and Schedule 1 you will then have the chance to adjust your income on Schedule 1. For example unemployment compensation may be taxed by another jurisdiction but it is not taxable by New Jersey so you cannot include this income on line 1 of Schedule NJ-COJ.

Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all employers as of March. Dont include in the. Calculate Deductions and Taxable Income.

Payroll HR and Tax Services ADP Official Site. The IRS says all supplemental wages should have federal income tax withheld at a rate of 22. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28.

This is the simplest method so chances are your employer most likely will withhold the percentage from your bonus. OrganBone Marrow Donation Deduction If you donated an organ or bone marrow to another person for transplantation you can deduct up to 10000 of unreimbursed expenses for travel lodging and lost wages related to the donation. If any states dont apply to you leave them.

Notice 2014-7 provides guidance on the federal income tax treatment of certain payments to individual care providers for the care of eligible individuals under a state Medicaid Home and Community-Based Services waiver program described in section 1915c of the Social Security Act. FUTA Taxable Wages. The next question you should be asking yourself is How do I figure my taxable income This step will help you find your taxable income after deductions.

Some Alabama municipalities also impose occupational taxes on salaries and wages. Complete Schedules NJ-BUS-1 and NJ-BUS-2 to calculate the amount of the adjustment or loss carryforward. 401k distributions including contributions made on or after January 1.

Form NJ-W-4P Certificate of.

Aatrix Nj Wage And Tax Formats

New Jersey Nj Tax Rate H R Block

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein

Nj Takes Another Look At Tax Bracketing Nj Spotlight News

Aatrix Nj Wage And Tax Formats

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

Pay Stub Templates 10 Free Printable Word Excel Pdf Science Words Templates Words

2020 New Jersey Payroll Tax Rates Abacus Payroll

2018 New Jersey Payroll Tax Rates Abacus Payroll

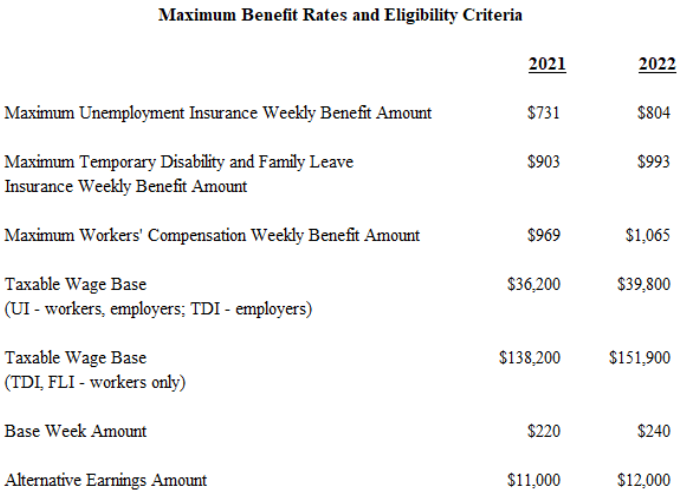

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

Aatrix Nj Wage And Tax Formats

2021 New Jersey Payroll Tax Rates Abacus Payroll

Aatrix Nj Wage And Tax Formats

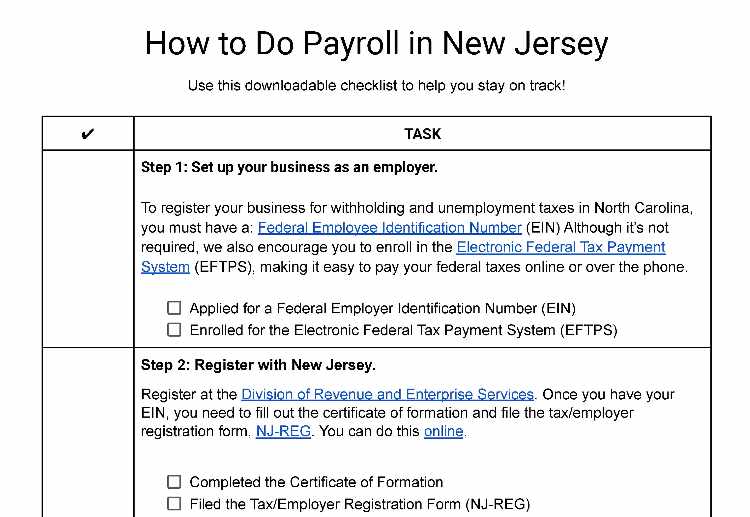

How To Do Payroll In New Jersey Everything Business Owners Need To Know

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective